04 May, 2020

By Colleen Waymel, Chief Operating Officer

The right support will help you keep pace with the fast-moving demands of the novel coronavirus pandemic (and future-proof your benefits approach) without getting overwhelmed.

Right now, HR professionals are facing some of the most challenging moments of their careers. Across nearly every industry, Human Resources teams are balancing caring for their employees while keeping their businesses afloat.

As Chief Operating Officer at Empyrean, I am in constant contact with our clients to help them manage the impacts of COVID-19 on their organizations. Our leadership team is also carefully monitoring the situation to keep our employees safe and our clients’ services running smoothly.

Empyrean has extended our work-from-home policy through at least May 31. All of Empyrean’s implementation and ongoing service teams are virtually enabled and successfully providing 100% of services to all of our clients while working remotely – providing certainty for our clients in an environment where uncertainty abounds.

Empyrean will continue to follow official guidelines and act in the best interest of our employees and their families. Out of an abundance of caution, we will be conducting a phased re-entry into each of our offices once it is deemed safe for employees to return.

For now, the rapid changes surrounding COVID-19 have left many people wondering what’s next. In the meantime, employee benefit professionals must remain flexible and ready to make major shifts in the way they manage their workforces.

It’s a lot to take on, but a solid benefits administration partnership can make these challenging tasks and unprecedented times less stressful. At Empyrean, our teams are actively working with each of our clients to ensure they have the resources and support they need to protect their people and businesses.

In discussions with our clients, we’ve identified three key ways that employers are leveraging technology and service solutions to adapt to growing demands from COVID-19. Here’s a quick breakdown of these approaches, as well as ideas on how to utilize them within your organization.

Offering Special Health Care Benefit Enrollment Windows

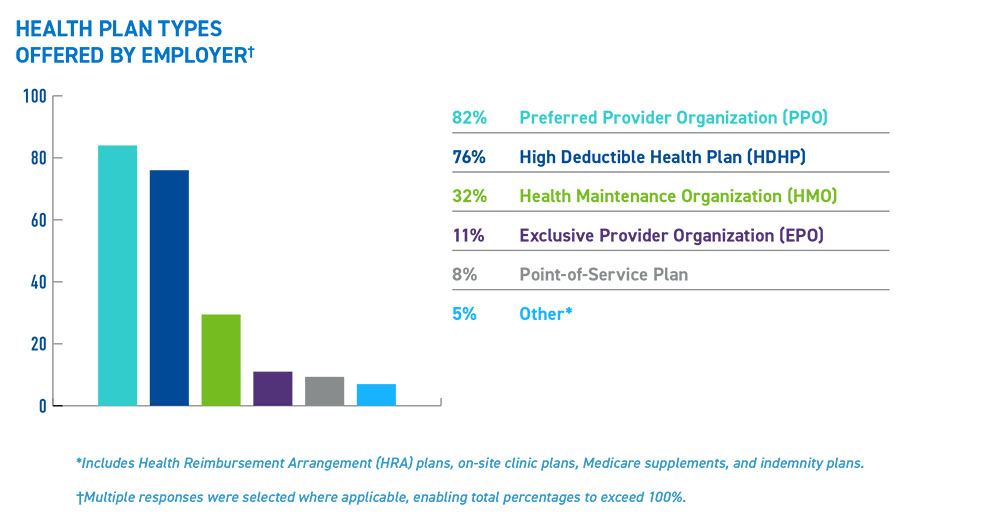

While many employers’ annual enrollment windows have already passed, some providers are offering special enrollment periods to employees who waived health plan coverage during their most recent open enrollment. Others are rolling out new voluntary benefit plans and programs such as hospital indemnity, critical illness, or telemedicine that may not have been available to all populations before. Providing employees with the opportunity to enroll in health benefits now will help minimize risks to their financial and overall wellbeing during these uncertain times.

However, these special enrollment periods can bring about big challenges for benefit teams. Like most HR-related tasks right now, there is a need for not only timely, but also creative solutions. Some coverage providers may only allow a short window of time for employees to enroll in their benefits, and these enrollment periods may need to open with very little notice (and are sometimes opened retroactively).

When offering a special enrollment period, you’ll need to quickly communicate this change to your employees and have enrollment processes in place as soon as possible – and your benefits administration partner will also need to ensure that your setup follows all applicable ERISA rules for a mid-year benefits enrollment.

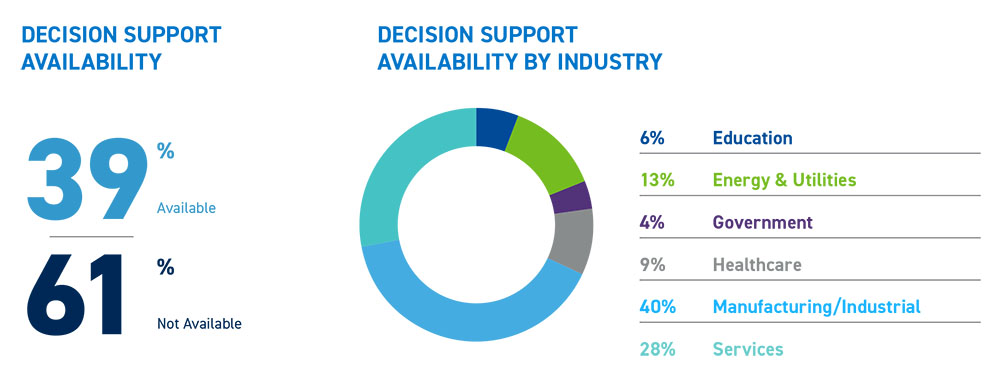

In the current climate, flexibility and responsiveness are crucial traits to help you keep ahead of the challenges you’re facing – especially the ones you least expect. The technology powering your benefits administration solution must be flexible enough to make quick work of the setup, testing, and execution required to complete this type of special enrollment window, so eligible employees have as much time as possible to enroll.

Increased Communication Efforts

Now more than ever, there’s no time for one-size-fits-all service: The information and service your employees receive must be specific to your offering and your policies, and must be updated to reflect any changes that you make.

Instead of generic, overseas call centers, your benefits partner should provide a dedicated, 100% US-based service team that understands your unique offering, policies, and employee populations. With a pre-established knowledge of your specific benefits program, your service team can adapt to any updates you make to your policies or processes. For Empyrean clients, many of these updates have included changes to dependent and event verification documentation requirements, coverage waiting periods, process deadlines, surcharges, appeals, and more.

A reliable benefits service center will also help alleviate the burden of fielding employee questions – a responsibility that can easily become overwhelming without the proper support.

Your vendor should keep an up-to-date understanding of your COVID-19 management approach and the potential for additional call volume that may result during this time. COVID-19 management options that your call center may promote can include telehealth services, employee assistance program (EAP) services, and any additional programs or information that further supports your participants.

Managing Compensation Reductions, Workforce Reductions, and Benefits Compliance

Unfortunately, workforce and wage reductions are a reality for many employers and their employees. While nothing can make these tough tasks less painful, the right partner can make the process less frustrating for you and your employees.

Your benefits enrollment and administration partner should be ready to help support eligibility and coverage changes that may occur as the result of workforce or wage reductions, as well as track leave or eligibility statuses as needed.

And if your business is experiencing furloughs, layoffs, or both, you and your employees need a trusted direct billing and COBRA solution that you can confidently rely on. Your vendor must be capable of managing the significant increase in direct bill and/or COBRA cases you may be dealing with. Ensuring employees have access to health coverage as they transition from your company is paramount, and will help protect you from big risks and potential fines moving forward.

Your benefits administration partner must also be capable of addressing the recent joint notice released by the Department of Labor, the Treasury Department, and the IRS. This notice provides new guidance on extending COBRA payment and election deadlines, as well as qualified life event processing deadlines. You will need to rely on your benefits partner to quickly and appropriately address the required changes as soon as details are known.

It’s critical that your vendor has the in-house compliance expertise to ensure your solution remains in compliance with COBRA, the Affordable Care Act (ACA), and all other benefits-related regulations during this time.

Despite the effects of the COVID-19 pandemic, regulatory compliance remains a major concern for businesses and their HR teams. While it’s possible some restrictions may be relaxed in the future, it is imperative that your benefits partner follows all official and current guidelines to help you stay compliant and keep your risk low as you navigate the unique situation surrounding COVID-19.

This remains a challenging time for employers and employees alike. However, organizations that have prioritized flexibility and adaptability are experiencing greater success with less stress, and are able to better care for their employees in the process. Your benefits administration provider should offer the technology and service solutions you need to help relieve anxiety and eliminate uncertainty – even throughout this uncertain time.

From all of us at Empyrean, we hope you and your family are doing well and staying safe during this difficult period. Thank you for helping protect your employees and our communities as we work to get through this together, and as we look forward to brighter days ahead.