17 March, 2022

As we enter the third year of pandemic-era life, it is clear that the way American workers view their employers, benefit programs, and overall workplaces has changed, creating both a significant and lasting impact on the HR and benefits space.

Our 2022 Benefit Trends Report uncovers the year’s top five trends influencing the state of employee benefits, sharing both quantitative data and expert insights that demonstrate how the many reactionary shifts, once thought to be temporary, in all likelihood may be permanent as the workplace continues to be forever reshaped by the COVID-19 pandemic.

Here are some of the key insights and takeaways from our full report.

1. Total Wellbeing is the New Normal

Benefit election data and employee behavior show that today’s employees have come to both expect and demand a broader range of supplemental benefit offerings from their employer, making an increased focus on total employee wellness a significant benefit trend again this year.

Enrollment data collected from the over 4.6 million participants accessing their benefits through the Empyrean platform shows that employees continue to gravitate towards supplemental offerings, selecting benefits that align with the changes they have experienced in their own lives. Some notable shifts include:

- Shifts away from office-centric benefit enrollments, including a 16.58% decrease in commuter benefit participation

- Enrollments that reflect remote and hybrid work arrangements

- 56.37% increase in pet care benefit enrollments

As our report explains in further detail, Empyrean’s experts forecast that employers will continue to trend towards taking a more holistic approach to their benefit offerings due to employee and market pressure to do so.

2. Improved Consumer Education is Driving Adoption, Employee Vulnerability is Accelerating the Trend

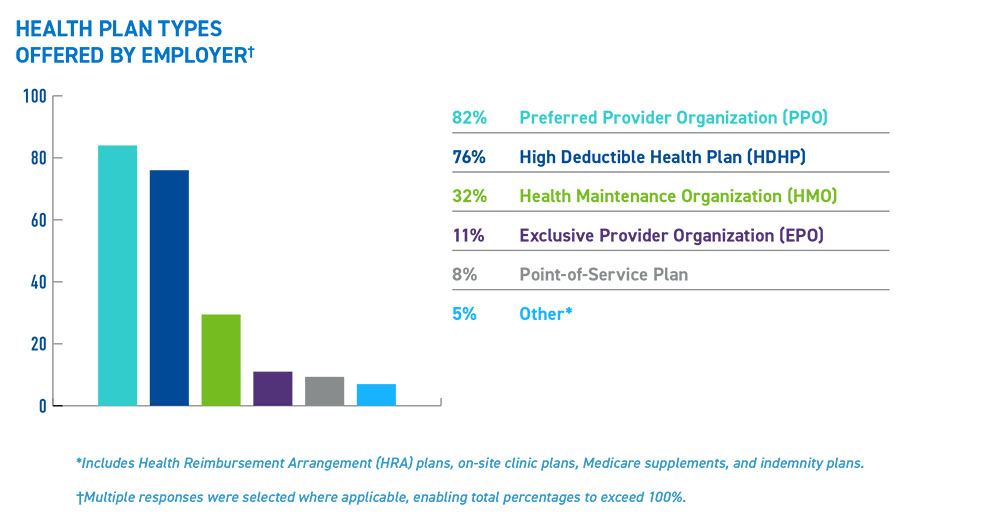

Since the introduction of the HDHP, employers have leaned on supplemental benefits as a way to round out traditional programs, and plan sponsors have spent significant resources educating their employees on why enrollment in these supplemental programs can be advantageous.

Data suggests that this education has started to take hold. Whether employees are looking for a better work-life balance, financial planning support, or new ways to cope with stress, the adoption of voluntary benefits is improving.

Some of the enrollment increases discussed in our report include:

- Hospital Indemnity (9.8% increase)

- Accident Benefit (6.95% increase)

- Critical Illness (5.85% increase)

After two years of pandemic life, it may come as no surprise that more employees are enrolling in benefits that insure for catastrophic events, perhaps recognizing their own physical and financial vulnerabilities during the public health crisis.

Download our full report to learn more about both continued and emerging trends related to mental health and employee burnout, and predictions that employees will continue to lean towards benefits that round out their traditional medical benefit programs.

3. Increased Focus on Using Benefits to Attract & Retain Talent

According to the Bureau of Labor Statistics, a record 47.4 million U.S. employees voluntarily left their jobs in 2021, making the need for improved attraction and retention through benefits an emerging trend in 2022.

The volume of quits this year has made it clear that employers who do not meet the evolving demands of employees can expect to see high levels of turnover. The Great Resignation has had a tremendous impact on health and welfare benefits, increasing the need for employers to rethink their benefits strategy and better demonstrate the value of their benefits program to both future and existing employees.

As described in our report, we predict that as the war for talent continues, HR teams will need to work together to better understand what their employees’ benefits needs actually are, and create a positive journey throughout the employee lifecycle, starting with the candidate experience and communications.

Traditional, supplemental, and non-monetary benefits will play a starring role in an employer’s ability to differentiate themselves against the rest of the market. Delivery of a positive employee experience, from candidacy through termination, will be a key driver in an employer’s ability to attract and retain talent.

4. Increased Need to Deliver & Communicate a Positive Benefits Experience

While employers are working hard to develop a strong benefits strategy that combats attrition and contributes to positive company cultures, equal effort must be made to ensure employees have positive experiences when enrolling in and utilizing these benefits, as research has shown employees will leave an organization for a role offering a more competitive benefits package.

The problem for many employers, however, is demonstrating that their benefits program is in fact valuable.

In a 2021 Voya consumer survey, one-third of respondents reported that they did not fully understand any of the employee benefits they enrolled in during their most recent open enrollment period. Despite materials and support available during open enrollment and throughout the year, many employees lack a full understanding of their benefit coverage and how to make cost-effective selections that are sized appropriately for their unique needs.

Providing employees with meaningful, year-round benefits education continues to be a major challenge for employers. Only 19 percent of organizations report that they believe their employees have a high-level understanding of their benefit options and elections, and 88 percent of employers from the same study say their main employee communications goal is to help participants better understand and utilize their benefit offerings.

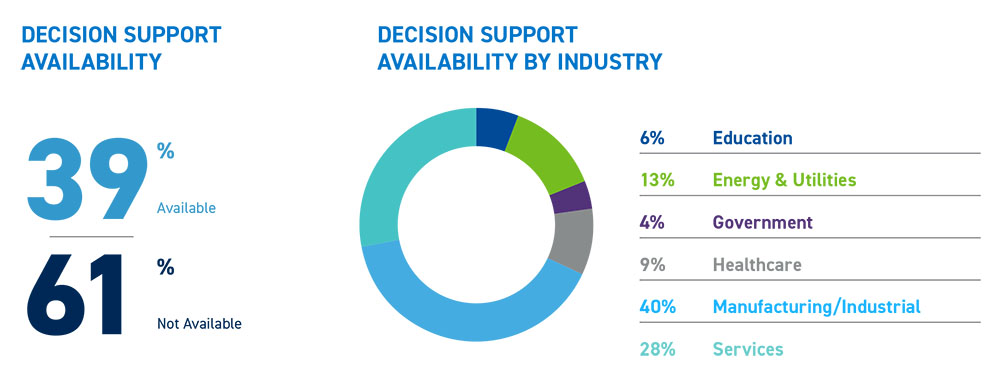

More and more employers are relying on decision support technology to help employees navigate employer-sponsored health and wellness benefit offerings through an individualized lens, enabling better education, selection, and utilization outcomes.

As described in our report, going forward we expect technology to play an even bigger role in the employee benefits experience, with employers leveraging predictive analytics and real-life claims data to drive benefits engagement. These platforms provide enrollment recommendation intelligence tied directly to the claims data of the individual enrollee, creating entirely customized forecasts based on real-life prior events.

Since the enrollment recommendations are tailored specifically for the employee, it is clear that the employer is not trying to drive them towards a lower cost plan that will save company dollars. Instead, the employer is able to demonstrate their commitment to providing the employee with benefit programs that meet the employee where they are in support of their total health and wellness.

5. Continued Developments Surrounding Benefits Regulatory Compliance

Employer-sponsored benefit plans have been historically subject to a significant and ever-changing list of regulatory compliance standards, however, the sheer volume and complexity of legislation governing the employment law space has been a continued trend since the start of the pandemic – and one that can be expected for years to come.

Our report outlines some of the most critical new and shifting regulations employers need to know, including trends that go beyond compliance standards to ensure positive employee experiences.

Looking Forward

It is critical that employers and benefit leaders take a step back from the “survival” modes employed since 2020 to understand the future of benefits and how to shift go-forward benefits strategies for both organizational and employee success.

Benefit leaders can conclude that the majority of benefits-related changes made by organizations in reaction to the COVID-19 pandemic are here to stay. Employer-sponsored health and welfare programs have been forever redefined to focus on mental and financial wellness benefits that support the whole employee in all facets of life, both inside and outside of work.

This year, employers have the opportunity to think differently about their benefit strategies to drive healthy and happy workplace cultures. As more businesses recognize the connections between benefits, employee experience, and positive organizational outcomes, leaders will continue to level up their benefits offering to build culture through benefits.

For additional data and insights tied to this year’s benefit trends, download your copy of Empyrean’s 2022 Benefit Trends Report today.