10 June, 2021

Six Ways to Better Educate Employees About Their Benefit Enrollment Options

Each year, HR and benefit teams put Herculean efforts into designing and building benefit plans that best support their employee populations. And it’s no wonder why – robust health and wellness benefit programs are linked to better employee and attraction outcomes and overall company performance.

Despite these efforts and best intentions to deliver a high-performing employee benefits program, many employees are still unaware of the benefit offerings available to them. According to a 2021 Voya consumer survey, 35% of survey participants reported that they did not fully understand any of the employee benefits they enrolled in during their most recent open enrollment period, with 54% of millennial employees falling into that category. Employees are thirsting for better benefits education, as 66% of survey respondents said that they want their employer to help them better understand and navigate their benefit enrollments.

Unfortunately, a lack of benefits education and awareness can have dire consequences to both the employee and employer. Employees may opt for more expensive plans because they do not understand how a less costly option may better suit their coverage needs, and they may avoid some supplemental benefit offerings due to a lack of awareness of how these programs work or that they event exist.

On the employer side, failure to properly educate employees (and their dependents) on benefit offerings and usage can be both financially burdensome and a major miss when it comes to employer branding and employee experience. Employers who neglect to take the steps necessary to inform employees about their benefits demonstrate both a lack of employee support and an uncaring company culture, no matter how generous an employee benefit plan design may be.

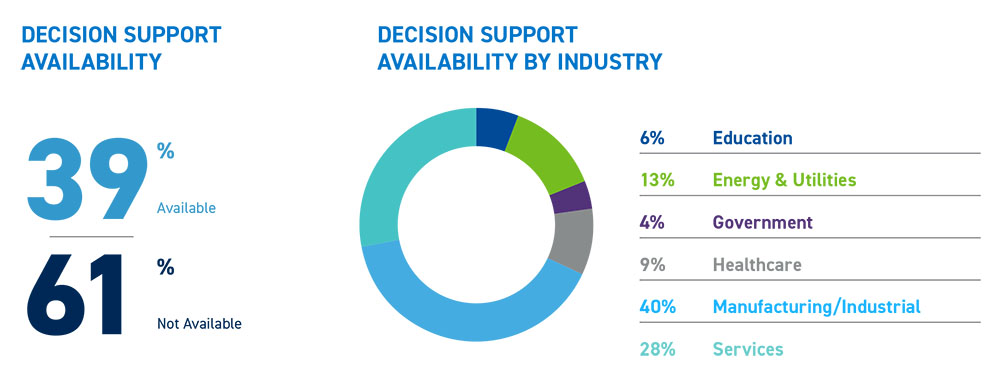

So, how can employers educate their employees about their benefits? Empyrean’s recent research report, “Top 5 Benefit Trends for 2021,” highlights the growing shift towards closing these employee education and communication gaps through the use of decision support tools and other methodologies.

Here are six critical steps employers should consider to better help employees understand and identify the benefit options that will most effectively meet their health, wellness, and overall coverage needs while making the most of their enrollments on a year-round basis.

1. Create a Benchmark to Measure and Address Gaps in Employee Benefits Knowledge

In order to fix a broken benefits education system and measure future success, employers must first take stock to understand current knowledge levels and where gaps have traditionally occurred. Conducting periodic benefit satisfaction surveys and employee focus groups can provide critical data and insights surrounding your employees’ benefits knowledge and needs. By asking targeted questions, you can better understand employee knowledge levels, common misconceptions, overall frustrations, and where more education is needed.

Another way to gauge levels of employee benefits knowledge is to carefully monitor and audit benefit enrollments and usage. If the majority of employees select certain benefits options, rejecting those which may be a better fit, it may be due to a lack of understanding rather than a specific preference for one option over another.

Creating these initial benchmarks can not only help fuel an organization’s go-forward benefits education and communications strategy, but will enable the employer to measure and report on the success of new initiatives.

2. Communicate Benefits Information Through Diverse Channels

Employees differ in the ways they prefer to learn about and synthesize information, and benefits are no exception. While some employees prefer digesting benefits materials and updates during in-person interactions, others respond better to a fully digital experience where they can access benefit resources on an on-demand basis.

To support the many different learning and communication styles within your workforce, it is critical to communicate benefits information using a variety of media. Employers should consider utilizing a combination of the following methods:

- In-person or virtual benefit workshops and enrollment meetings

- Detailed benefits handbooks and plan summaries

- Online technologies, including decision support tools

- Customized online benefits microsites

- Dedicated space on the company intranet

- Individualized telephone support provided by an internal team or outsourced third-party

3. Simplify Complex Benefits Concepts and Terminologies

It may be difficult for employees to understand, navigate, and best utilize their benefit offerings if they lack foundational knowledge about core benefits concepts and terms. A UnitedHealthcare consumer survey found that only 9 percent of respondents understood the meaning of four basic insurance terms—health plan premium, deductible, coinsurance, and out-of-pocket maximum. If employees struggle with common benefits terminology, they may also have a harder time grasping how some insurance and savings plans work.

By educating employees about key benefit concepts and terms, employers can improve overall benefits literacy and make it easier for employees to select right-sized coverage options that work best for them and for their dependents. You can support employees in this area by considering the development and rollout of the following resources:

- A glossary of benefit terms and concepts using simplified definitions and easy to understand examples

- Videos and other digital resources that cover benefit terminologies in simplistic terms

- In-person or virtual benefits workshops and education sessions that occur throughout the year

4. Implement an Active Annual Enrollment

Outside of a qualifying life event, annual enrollment periods are the only time employees can re-evaluate and enroll in employer-sponsored benefit programs. Due to these enrollment timing limitations, many employers utilize a passive open enrollment strategy to ensure there is no loss in coverage for employees who may miss the enrollment window. However, employers may be missing critical opportunities by employing a passive approach.

“We see that our clients who have implemented an active open enrollment see better results as it relates to the selection of cost-effective, right-sized coverage as well as the engagement with and utilization of those plans,” says Desta Millner, Strategic Accounts Advisor at Empyrean.

Millner also points out that employers with an active annual enrollment gain an opportunity to re-demonstrate the competitiveness and value of their benefits offering.

“Empyrean believes that benefits are the most tangible expression of a company’s culture and truly demonstrate the value an organization places on its people. Employers with a passive annual enrollment miss out on the chance to further bolster their employer brand and create that goodwill that drives positive employee experiences and loyalty.”

5. Utilize Decision Support Tools to Provide Employees with Right-Sized Benefits Recommendations

Decision support technology helps employees navigate employer-sponsored health and wellness benefit offerings through an individualized lens, enabling better education, selection, and utilization outcomes.

“Decision support technology takes a holistic approach to open enrollment,” says Jim Priebe, Chief Strategy Officer at Empyrean. “It educates your employees to see the bigger picture of how their benefits work together to meet their needs, and treats them as the whole people they are – not just a sum of parts.”

These recommendation engines, specifically those which integrate real-life claims data, can drive benefits engagement as the employee is now guided through the enrollment process and can see which plans and programs are right for them based on their individual needs, health and wellness outlook, and overall circumstance. Through predictive analytics, employees can better conceptualize which programs will be most impactful for them and their family from a financial and coverage standpoint.

Decision support technology can also help employees better understand the overall worth of their benefit plan by providing a transparent view of their employer’s financial contributions to these programs.

6. Make Employee Benefits a Year-Round Conversation Beyond Just Annual Enrollment Periods

A Unum poll of U.S. workers found that most employees spend 30 minutes or less reviewing their benefits prior to open enrollment. For many, those 30 minutes may be the only time of the year they interact with their benefits choices in a meaningful way.

To drive benefit education and engagement, employee benefits communication should occur year-round and not only be limited to the open enrollment period. By offering employees helpful resources at all times of the year, employers can further optimize benefits decision-making and improve overall benefits outcomes. Producing newsletters, lunch-and-learns, and providing AI-enabled decision-support technology are just a few ways you can help employees learn more about their benefits options before, during, and after open enrollment.

Empower Employees to Choose Benefits Wisely

Oftentimes, employees simply don’t know what they don’t know when it comes to benefits. However, by putting more relevant information into employee hands and offering tools and resources to help them navigate their options, you can help your employees make more informed and cost-effective benefits decisions throughout the year.

To learn more about trends in decision support and other employee benefit areas, download your copy of “The Top Five Benefit Trends for 2021”.